Hello Internet people, I’ll explain all the different Etoro fees and I’ll show you an example of what happens when you invest 1000 pounds on the platform and how the trading fees can eat up your profit, so invest with care!

Below is a video that will explain all the Etoro fees while trading stocks and CFDs. And you can click on this link to get to Etoro.

(*81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money)

DISCLAIMER: All the information about trading fees and calculations are just for reference and based on my research and opinion at the time I was writing this post. You should always check eToro’s fees page for most up-to-date fees.

CONTENTS

- Withdrawal Fee

- Currency Conversion Fee

- Spread Fees

- Overnight Fees

- Inactivity Fees

- Etoro Fees Calculator

- The conclusion to Etoro fees

eToro in summary

Etoro is one of the biggest CFD trading platforms in the world (according to Similarweb they have more than 20 million visitors per month). They are able to provide financial services to clients around the globe because of CFD trading. Therefore, you don’t actually own the securities/assets you buy, but instead, you are buying a contract. Learn more about CFDs.

From my experience, I consider eToro safe to use and I haven’t been scammed. Depending on your country, they are regulated by the Financial Conduct Authority (FCA) in the UK, by the Australian Securities and Investment Commission (ASIC) in Australia. All other clients are regulated by the Cyprus Securities and Exchange Commission (CySEC).

That said, they are running marketing campaigns claiming that they have commission-free stock trading, but this really just marketing talk with some fine print. In the end, you’ll have some costs even with stock trading. But to me, that’s not a show stopper.

eToro Withdrawal Fee

The easiest fee to understand on Etoro is the withdrawal fee of $5, which is charged every time you withdraw your money.

So it just makes sense to withdraw large sums of money at once, when you are happy with your trading profits.

This fee is a bit controversial as most other CFD trading platforms don’t charge this.

Minimum Withdrawal Amount

What about the Etoro minimum withdrawal amount?

Well, you need to withdraw at least $30. But to be honest I don’t think you should withdraw such small amounts. The fees will eat up all the money. Keep in mind that depending on the currency there will also be currency conversion fees.

eToro Currency Conversion Fee

Etoro’s trading platform operates with dollars only, so when you deposit money from other currencies, they take a conversion fee.

Just to confuse all the newbies, the conversion charge is calculated in pips. ![]() And the amounts depend on your currency.

And the amounts depend on your currency.

For example:

Let’s say you’ve just found 1000 pounds laying on the ground – yeah cause that could happen to anyone.

Now you decide to do a bit of trading on Etoro and you deposit the money at 1.3294 GBP/USD conversion rate.

So for 1 pound, you get 1.3294 dollars.

If there were no costs while converting your 1000 pounds, you would have about $1329.

On Etoro, the fee for GBP/USD is 50 pips or in other words 0.0050 or 0.5%.

If you want to learn more about what pip is check it out on Investopedia. But all you have to know is that one pip for GBP/USD or EUR/USD is 0.0001

We take the conversion rate and subtract the 50 pips

1.3294 – 0.0050 = 1.3244

This means after the fees you would have $1324 which means there is a $5 fee.

If you would do the same with Euros you would also pay $5 dollars in conversions fees.

Conversion fees depend on the payment method

Okay to make things a bit more complicated, the Etoro platform has different conversion fees depending on your deposit method. So the cheapest will be to choose wire transfer or online banking, and that’s what most traders do to avoid extra charges.

To make a wire transfer, just click on the “Deposit Funds” button in your Etoro dashboard, and choose wire transfer in the dropdown. Make sure you select the currency your money is in. Just so you know, the wire transfers take from 4-7 days to appear on your account.

As you can see from the above image, for pounds it doesn’t matter if you use wire transfer or other methods, but for most other currencies, it might be good to wait few extra days to start trading cheaper.

These fees will also apply when you withdraw money.

Please note! You don’t need to worry about the fees below if you are just copy trading (a.k.a. social trading) because copy traders will handle everything for you while they trade. You are basically just copying their portfolios.

So make sure your portfolio has traders that have also lower risk ratings, that way you will diversify the investment and reduce financial risk.

In other words, when you see profits on your account, that’s what you are going to get (Minus withdrawal & currency conversion fees).

eToro Spread Fees

In summary, Spread fees are charged when you buy anything on eToro, stocks, and any other assets or instruments, however, they are included in the buying price that you see in eToro.

And it’s really specific to what you want to trade.

Commodities and currencies are in pips. Whereas stocks and some other assets are in percentage.

Let’s assume you are buying Apple stock, the spread fee for stocks is 0.09%.

So let’s say, to buy one Apple stock you need $191,77.

And to sell at $191,41.

Thus, this means that the real price is somewhere in the middle, roughly 191.60.

If you are selling (shorting) you get this by $191.41*0.0009 = $0.1723.

And if you are buying $191.77*0.0009 = $0.1726.

Therefore, it’s the stock price times 0.09% and you get the spread fee.

If you would buy 1 apple share, you would pay about $0.17 in spread fees on Etoro. If you buy 5 shares, you pay almost a dollar. I think you get the point.

eToro Overnight Fees

Like most other CFD trading platforms, eToro charges overnight fees, which is basically a small fee for them to lend you the money to hold the asset overnight.

This again really depends on what you are trading, for example, if you trade stocks and you don’t leverage them then there are no overnight fees. If you do leverage, it means eToro is lending you money so they are collecting an interest rate on it.

More about CFDs in this video:

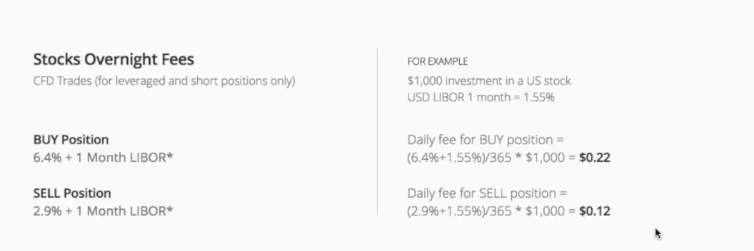

Here is the list of the overnight fees for stocks. By the way, this is only for leveraged and short positions.

Example of overnight fees:

$1,000 investment in a US stock

USD LIBOR 1 month = 1.55%

Daily fee for BUY position =

(6.4%+1.55%)/365 * $1,000 = $0.22

Daily fee for SELL position =

(2.9%+1.55%)/365 * $1,000 = $0.12

So the overnight fee for US stock is 22 cents per day on Buy and 12 cents per day on SELL.

Let’s break down the BUY position. So you can understand what’s going on.

- 6.4% is the Etoro fee.

- 1.55% is USD Libor for 1 month

You are probably wondering what the heck is Libor?

Well, it stands for the London InterBank Offered Rate.

This is the interest rate at which banks borrow money from each other internationally. And it’s one of the benchmark rates that indicates how much it costs for banks to borrow money.

And it is constantly fluctuating so you have to look it up when you do the calculation

- 365 is the number of days in a year.

- And $1000 is the investment.

In other words, in this case, you end up paying $22 cents for a day.

And keep in mind that overnight fees are applied to the borrowed amount. So if you have 1000$ and you leverage that by x3, which means you have $3000. The fee is applied to the $2000 you borrowed.

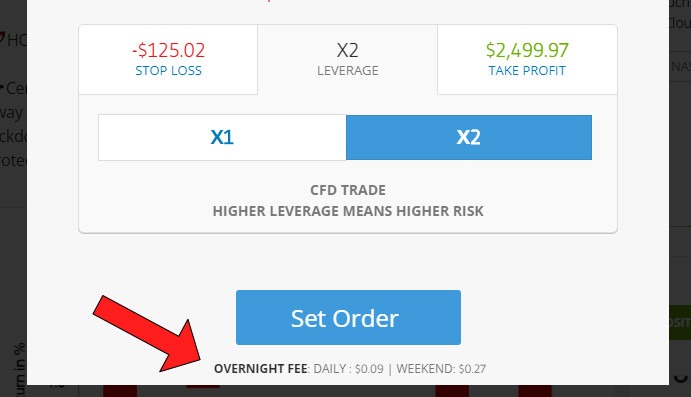

But don’t worry, anytime overnight fees are applied, they appear at the bottom of the trading popup so that traders can easily see how much it costs per day.

Inactivity Fees

If you don’t log in for 12 months to your account, eToro charges a monthly inactivity fee of $10 per month. Until you ran out of balance on the platform or your login.

So don’t forget to login from time to time.

Etoro Minimum Deposit And Maximum Limit

Next, let me explain the minimum deposits on Etoro.

Here is a quick video that explains everything:

For most countries, the minimum is $200 for first-time deposits.

There are a few exceptions though:

- USA & Australia need only $50 dollars.

- and Israel ($10,000).

Check Etoro official minimum deposit page for any updates.

(*81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money)

However, the min. the amount also depends on the deposit method. So for wire transfer, the minimum is $500 dollars. And for the rest, it’s the above-mentioned amounts.

After the first time deposit, you just need at least $50 to top up your account.

And one more thing, if you have not completed Etoro’s verification, the maximum you can deposit in total is $2,250. Otherwise, there are higher limits and you can find them on this page.

The maximum deposit amount is the easier one. There is a maximum deposit amount of $10,000 per day. That’s pretty much it.

eToro Fees Calculator

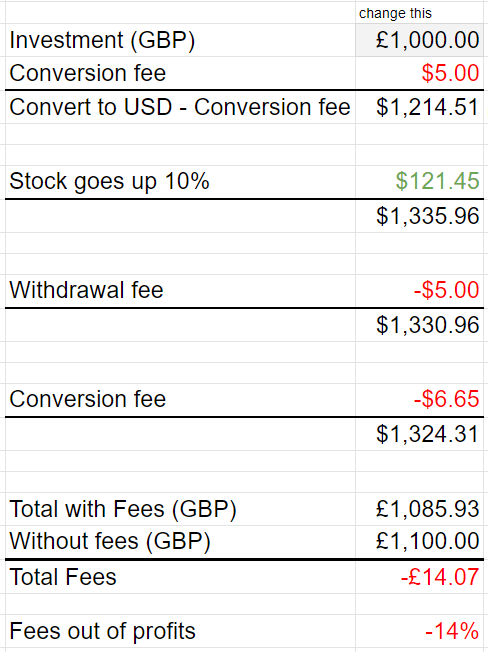

Okay, let’s take a look at an example with the most common fees put together.

You can download the Etoro fee excel calculator.

The conditions I’ve set for this trading example.

- The conversion rate from pound to US dollar is just over 82 cents.

- The opposite conversion rate is just over 1 dollar and 22 cents.

- The conversion fee is 50 pips or 0.005

- Stock will go up by 10%

- The spread fee is 0%

- No leverage applied

For simplicity, I won’t include overnight fees as these are mostly in place when you leverage your trade and for most people, it won’t apply.

Alright, at the top you can see we have invested 1000 pounds.

When we convert it to dollars, we end up with $1219.41.

Right, from the start we are going to have $5 dollars in conversion fees.

So we are left with $1213.41, which we take and buy stocks on Etoro with the whole amount.

Now we’ve waited for a month and it happens to be that we’ve chosen the right stock and it goes up by 10%. In this case, we’ve just made a bit more than $121 and which means we have now $1335 in total. And we’ve decided to cash in.

Just before the money is sent to your account, there will be a withdrawal fee of $5.

And another conversion fee when we convert from dollars to pounds which is just under 7 dollars.

Conclusion to calculation

When we convert the $1324 back to pounds, you can see that we are left with 1086 pounds. However, without fees, we would have 1100 pounds. That means there were almost 14 pounds of Etoro fees. Which is 14% of our profits.

Fees really depend on the initial amount and stock gains.

Now the fees get smaller in proportion when you invest more money or your stocks go higher up in price.

But with 5000 pounds it would be 11% out of profits. So it really depends on how much you invest.

Or if the stock went up by 20% even with 1000 pounds, the fees would be 7% out of profits. But hey that’s pretty much the case on all trading platforms, especially when dealing with CFDs.

You can download this excel calculator, so you can play around with it. Just keep in mind it’s just for indication and based on my opinion. You should not base your investing decisions on the calculator.

The conclusion to Etoro platform fees

I personally think eToro is not the cheapest CFD trading platform. On the other hand, they have heavily reduced their fee structure in late 2019 and I’m a big fan of social trading and the financially minded (not sure that’s a real word?) community on the platform.

In addition, it’s super easy to use and you have a lot of choices of what to trade, such as stocks, and commodities. All on one platform and could be in your portfolio!

However, the biggest advantage I see with eToro is a service called copy trading. They give you all kinds of tools and charts to analyze the traders and the risk levels, so you can start investing on the side by just following one of the “pros”.

If you are an experienced trader, you can make commissions by getting people to copy your portfolio. More about Etoro popular investor program. (*81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money)

If you choose to go with eToro, I would appreciate it if you could use this link to eToro, as they will pay me a commission if you sign up through the link. Thanks!

Besides eToro, I’m using a few other platforms to trade stocks and they are a bit cheaper, but they have fewer options as they are not trading CFDs, but actual assets.

If you like to be more hands-on and control all the trades then you should check out other platforms, where you have more control and fewer fees such as Degiro or Lynx Broker. But be aware you also get fewer options in terms of what you can trade.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Hi Robert,

Thanks for your review, that very help me to understand, would you share with me what the cheapest platform, thank you

Regard

Novan

Hi Novan,

Glad to hear this was useful. This really depends on your country, but I would go for the providers that charge a fixed fee per transaction. I think it’s easier to calculate and keep track of. I use Lynx, but there is a cheaper provider called Degiro. I think they charge 3 or 4 eur per transaction.

I hope this helps.

Robert

Hi Robert,

Wonderful article. You’ve helped me understand it better through the examples. 🙂

I have a couple of questions: (i) are ETFs also subjected to the same fees as in this article? I’ve read that they do not incur fees, but unsure if it means all fees; and (ii) I’m from Philippines moving to Germany and interested in investing in ETFs. Which platform do you recommend to use (w/ minimal fees)? I am thinking of buy and hold for the long run. Primarily buying stock market etfs. Thank you so much. 🙂

Hi Deni,

I think most fees do affect the ETFs, they might have slightly different fee amount, but fees apply to them too.

If you want it easy then use etoro (but expensive), cheaper platforms.. you can try: https://www.degiro.eu/ but it’s a bit more complicated to use it. Also buying ETFs is a bit more tricky. They charge flat fee for a trade.

I hope this helps you get started and enjoy Germany!

Robert

Hey.

Seems to me that using “leverage” would make most people lose money or get even at best.. With LIBOR of 1,55%+6,4%interest fee (annual) + the Exchange rate from EU currency to USD.. We talking about close to 8-9% in cost of the “borrowed” amount. So you only start to make money after that stock shows +9% in annual profit. Stupid leverage option and a way for etoro to steal your money.

Degiro charge 1.5% for leverage amount.

Hi Michael, etoro is definitely more expensive, especially when leveraging.

Also personally I’m really cautious with using leverage.

I’ve seen some companies offering x100 on cryptos etc, which is just madness.

I’m also considering to try out DeGiro, I’m with Lynx right now (besides etoro)

Thanks for this super helpful overview. I’m looking into Etoro and Degiro (UK-based) and don’t mind a more complicated workflow. Are you aware of a similar overview for Degiro? That would help a lot. I’m trying to find out all their fees but haven’t been able to find all the same details as you have here from Etoro.

Hello Robert, thanks for the efforts. As you said the advantage of etoro is the copy trading where youmentioned these fees does not apply. Do you have or is there any good gyude how it works and the fees explained? Also are there other platforms with a copy trading options?

Thanks a lot.

Hi Biser,

My pleasure! I think I wasn’t clear, but the fees do apply to copy trading, it’s just the spreads & overnight fees etc. you don’t need to think about that. Because the trader who you copy will take care of that.

I’m not aware of any other copy trading platform, I’m sure there are some but I haven’t tried.

Thanks for this super helpful overview. Very good article!

Could you please explain what calculation you made to get 25 euros commission Conversion fee?

Degiro It is excellent, I recommend it 100%

Did anyone have experience with Tradestation?

Hey Leo,

I’m happy this helped you!

For the conversion fee you can see more here, but essentially you have different “Pip” amounts for each currency. 100pips = 1%, so since the example has 1000 x 250 pips (2.5%) = 25e.

I have no why they are called Pips and not just %, but I guess finance sector needs to stay different 🙂

Hi Robert

I try to figure out the cost calculation crypto leverage, if there is any. Is it the same as for the stocks?

Many thanks.

Marco

Hi Robert

May sound a stupid question but on etoro eg..

I had a stop loss closed too early, the stop loss was supposed to close at 2647.02

But while I’m watching it it never hit and even on the charts it shows the highest it hit was 2646.4 max , my leverage was x5 . Is there a leverage fee that makes it close early or why does it show 2647.02 if it doesn’t actually close at this. It shows in my history it closed at this when it actually didn’t. any help would be super. Thanks

Baz

Sorry leverage was x20.

Hi Robert,

Really nice your explanation. However, I am still a little bit confused with copy trading. So if I copy a trader that buys and sells each day does this mean that I will be charged with fees each time he/she buys a stock and sell it?

Sorry for the noobie question but I am still learning.

Thank you.

Hi Pedro,

No worries, I’ll be honest I don’t know how exactly it works. But what you see on your dashboard, will be what you will receive. So the copy traders take care of the rest. If the copy trader gets charged (for example spread fee) you will be too.

But again, I wouldn’t worry about that too much, you just see that the copy trader has had success in long term and you should be good 🙂

Robert

Hey Robert,

Very good article. Good job!

My question is about Commodities like Oil. Do i get charged if I invest in Oil with no leverage? I mean, highly daily charge? How that works? The explanation in etoro is a bit confusing.

Thanks a lot!

Gonçalo

From what I understand, eToro first charges Currency Conversion Fee when I deposit funds to my account, then when I want to take the profit out they charge Withdrawal Fee and Currency Conversion Fee again. So basically they charge at the beginning of investing and at the end when withdrawing the money, yes? What about fees when moving money between different assets and products? For example, there is no fee when I buy stocks. So if I move my money between different stocks they will not charge me any fee until I decide to withdraw my money?

Bastards is being way to polite. I also was told by all my friends and family NOT to do this But I was a DUMB ASS and did it anyone. You know I am always right (NOT). They got 50k out of my pocket and when the account was over 115k.My account went down 111k in less than 30 minutes leaving $8,400. They knew this was my retirement money and didn’t give a damn. I guess they were done with me then because no one would take my calls.If it sounds to good to be true, it is. Luckily for me I was introduced to LukeReynold@protonmail.ch he helped me get all of my funds back.

Hi Robert,

I am currently looking at trying to trade some oil stock. If I select X1 leverage is still shows daily and weekend fees, do these apply to me if I am using X1?

Also, oil is currently at $19, however Etorro will not let me trade unless i use a minimum of $2000….do you know why this is?

Great website BTW and I look forward to your response.

Charlie

Is the 14% due to fees is taken from the initial fund or from the profit?

Hello,

It’s from the profit. I like to calculate like this, but you can easily calculate the same thing from the initial investment + profits/losses.

Hi Robert.

Nice explanation, thank you very much.

One thing I am still not sure I know is which conversion rate is used in the deposits and withdraws. If I withdraw, it will be on my account in euros, where can I find which conversion rate will be used so I can add to your calculator?

Hi Robert, aren’t the fees that you pay in your example calculation 1.4%, instead of 14%?

Hi David,

I’m calculating the fees from the profit. But what you say is also right.

Thanks a lot for the wonderful information. Tc

You are welcome Sai! I’m happy to hear this helped!

Hello,

I have a Revolut card. Can I deposit USD directly to eToro account via the card?

I know they are saying that they not accept USD from Revolut, but I thing this is for bank transfer.

I saw a video on youtube that you could do it, but it’s been removed since, so I’m not sure.

Hi Robert, i have read through all the information. If accidently (through bank transfer) depositing us dollars to etoros euro account number instead of their dollar account number, How much fees would you reckon should be charged, interpreting the etoro fee system? Would the amount really be converted from dollars to euros and back to dollars making etoro charge conversion fees twice or what would make sense in this case?

no idea how they handle this, I don’t think they will even accept the money if you sent it to the wrong account.

So maybe the payment will just bounce?

Thanks, very helpful 🤙

you are welcome!

I’ve just realised today that UK investors in etoro are also currency speculators! When you want to withdraw your money depending on the currency exchange rate you could receive less than you invested!

Dam good job robert very very helpful. I really did not understand the fee system of etoro, but they seem shady to me. I mean pricing and fees should be easy to understand and etoro is NOT. With that said, if pricing is to difficult to easily follow(which for me it is) then use anther exchange, its just that simple. Thanks again, hey can you look at the pricing of Alto and there self directed ira’s.